In today's fast-paced business environment, the ability to make informed financial decisions is crucial for success. One of the most effective tools for achieving this is a well-structured financial model. Financial model templates provide a foundation that allows businesses to visualize their financial future, assess risks, and evaluate various scenarios. Whether you are a startup founder, an investor, or a seasoned executive, utilizing these templates can streamline your planning process and enhance your strategic decision-making capabilities.

With a plethora of financial model templates available, it can be overwhelming to choose the right one that fits your needs. These templates offer a systematic approach to building sophisticated financial models that are not only efficient but also transparent. They enable users to easily input their data and assumptions, resulting in clear outputs and projections. By unlocking the potential of financial model templates, you can pave the way for smarter financial strategies and, ultimately, greater success in your endeavors.

Types of Financial Model Templates

Financial model templates come in various forms, each tailored to specific needs and industries. One common type is the three-statement model, which integrates the income statement, balance sheet, and cash flow statement into one comprehensive model. This approach helps users understand how the financial statements interact with each other, making it a fundamental tool for financial analysis and projections.

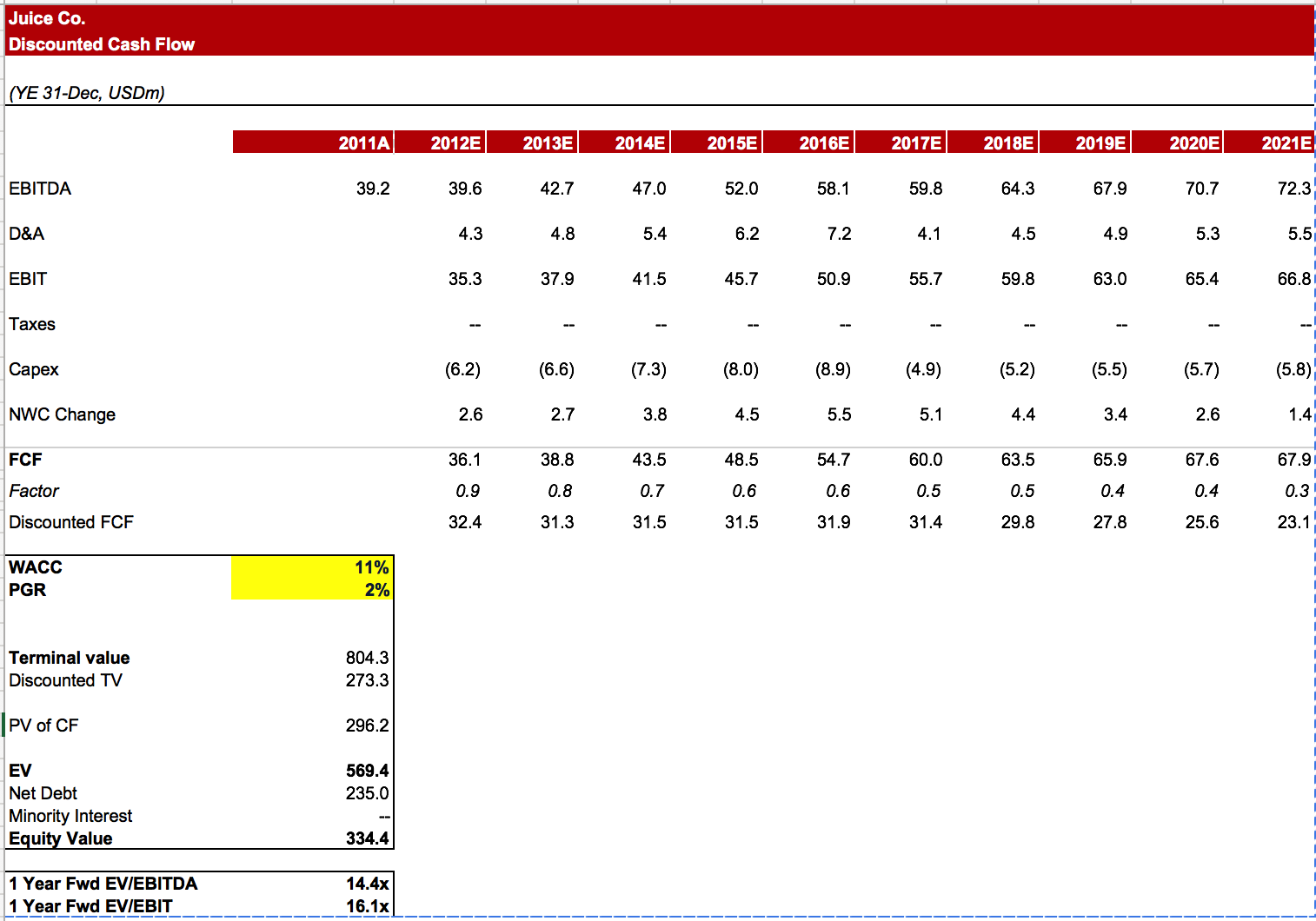

Another prevalent template is the discounted cash flow model, often used in valuation scenarios. This model focuses on estimating the present value of future cash flows, allowing investors to assess the worth of an investment based on projected earnings. Its structure typically includes assumptions about revenue growth, operating expenses, and discount rates, enabling users to determine investment viability in a clear manner.

Sector-specific models also play an essential role in financial modeling. These templates are designed to cater to unique industry requirements, such as real estate, banking, or startup ventures. They include specific metrics and considerations relevant to the sector, helping users to create more accurate forecasts and financial plans. Whether you are analyzing a real estate project or developing a startup's growth plan, these specialized models provide the framework needed to succeed.

Key Components of a Financial Model

A well-structured financial model relies on several key components that work together to provide accurate forecasts and analyses. The assumptions section is the foundation of any financial model, holding the critical inputs that drive the calculations. These assumptions can include revenue growth rates, cost trends, and financial assumptions like tax rates and capital expenditures. Establishing realistic and well-researched assumptions ensures that the model reflects true market conditions and facilitates informed decision-making.

Another essential component is the income statement, which outlines the projected revenues, expenses, and profits over a specific period. This statement allows stakeholders to understand how the business is expected to perform financially, highlighting trends in revenue growth and expense management. Additionally, it provides insights into profitability through key metrics such as gross margin, operating income, and net income. It's crucial for the income statement to be linked to the assumptions logically, as this transparency builds trust in the financial projections.

The cash flow statement is equally significant, as it details the inflows and outflows of cash within the business. This component shows how well the company can generate cash to meet its obligations, fund operations, and invest in growth. A comprehensive cash flow statement breaks down cash flows from operating, investing, and financing activities, allowing users to spot potential liquidity issues early. Integrating this statement with the income statement and balance sheet creates a cohesive view of the company's financial health, making it an invaluable part of any financial model.

Best Practices for Using Financial Models

To get the most out of financial model templates, it's essential to start with a clear understanding of the purpose of the model. Define your objectives and make sure the template aligns with your specific needs. Whether you are forecasting revenue, analyzing costs, or valuing an investment, clarity in your goals will guide you in choosing the appropriate model structure and inputs. Take the time to customize the template, ensuring it captures the nuances of your unique business scenario.

Another key practice is to regularly test and validate your financial model. This involves running sensitivity analyses to see how changes in key assumptions impact your outcomes. By identifying critical variables, you can better understand risks and opportunities. Additionally, having a solid documentation process for your models enhances transparency and ensures that anyone reviewing the model can easily follow your logic and reasoning. This step is crucial for collaboration and future revisions.

Finally, establish a routine for updating your financial models to reflect new data and insights. This allows the model to remain relevant and accurate over time. Set intervals for review, whether monthly or quarterly, to incorporate actual results and adjust forecasts accordingly. Continuous refinement of your financial models not only improves accuracy but also enhances your overall decision-making process, positioning you for greater financial success.